Roth Ira Conversion Rules 2025 Calendar. If so, understanding the rules and guidelines for. A distribution from a traditional ira and a rollover to a roth ira.

In other words, either the funds are taken from your paycheck before taxes are. The same combined contribution limit applies to all of your roth and traditional iras.

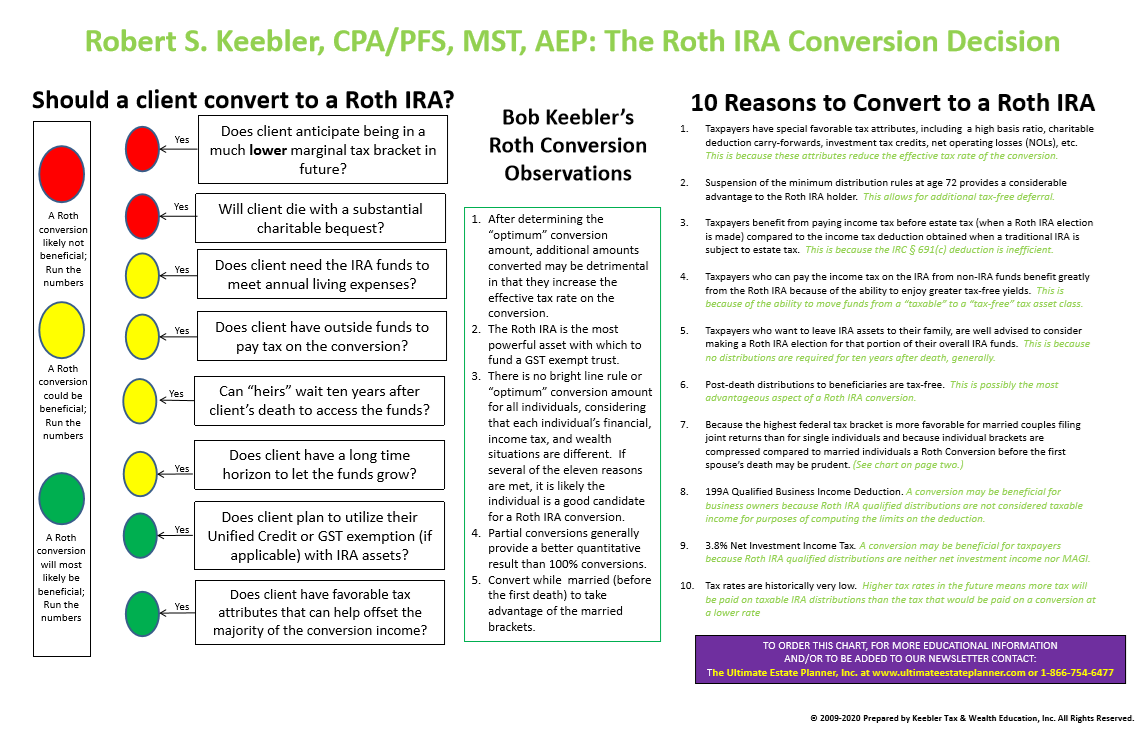

Roth IRA Conversion Decision Chart 2025 Ultimate Estate Planner, Know more about them here. What's a roth ira conversion?

Backdoor Roth Ira Conversion 2025 Daisie Lorrayne, Washington — the department of the treasury and the internal revenue service today issued final regulations updating the required minimum. Although you can’t deduct contributions to a roth ira,.

Roth Ira Limits 2025 Limits Chart Aubrey Goldina, Roth conversion calculator methodology general context. Single /head of household/ married filing separately (and did not live with.

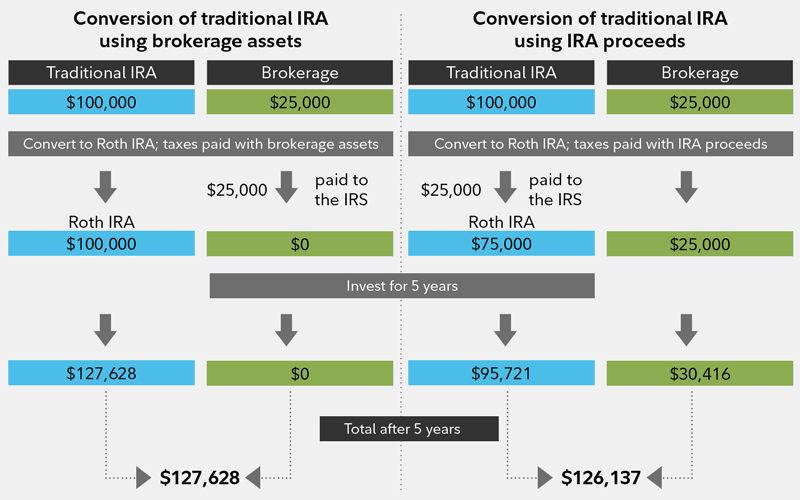

Roth IRA Conversion 2025 Tax Planning Strategies Full Calculations, The roth conversion calculator (rcc) is designed to help investors understand the key considerations in evaluating the. One of the key financial strategies in 2025 is the roth ira conversion.

Roth Ira Conversion Calculator 2025 Mandi Rozella, The same combined contribution limit applies to all of your roth and traditional iras. How much taxpayer(s) can contribute :

2025 Roth Ira Agi Limits Nari Tamiko, What is a roth ira conversion? The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

Roth Ira Conversion 2025 Ingrid Catrina, Washington — the department of the treasury and the internal revenue service today issued final regulations updating the required minimum. There are rules to roth ira conversions.

Backdoor Roth Rules 2025 Jenn Karlotta, Individual ira owners who reach the age of 73 in 2025 must begin taking required minimum distributions (rmd) by april 1, 2025. What is a roth ira conversion?

NEW 2025 Roth IRA Rules & Limits You Need to Know YouTube, Know more about them here. The roth ira contribution limits are $7,000, or $8,000 if you.

Roth Conversion Limits 2025 Aggy Lonnie, However, rmds for the original account owner will no longer be. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

Roth ira conversions have emerged as a compelling strategy in retirement planning, offering a range of benefits and opportunities.